A Year of Shareseer

I started Shareseer just about a year ago and had my first launch at the thankgiving of 2017. Shareseer was born out of my pain of finding company filings as I was learning about valuation. You can read about that

here.

The features I am especially proud of are:

- An algorithm to identify unique risks e.g Risks for $PM.

- Shares outstanding plots over time . e.g Shares outstanding for $NVDA

- A consolidated insider transactions page which rolls up individual transactions for a given filer. This is also an entire day faster than major brokerages.

- A real time twitter like feed of filings.

Shareseer is the end result of following my curiosity, something that gives me endless joy.

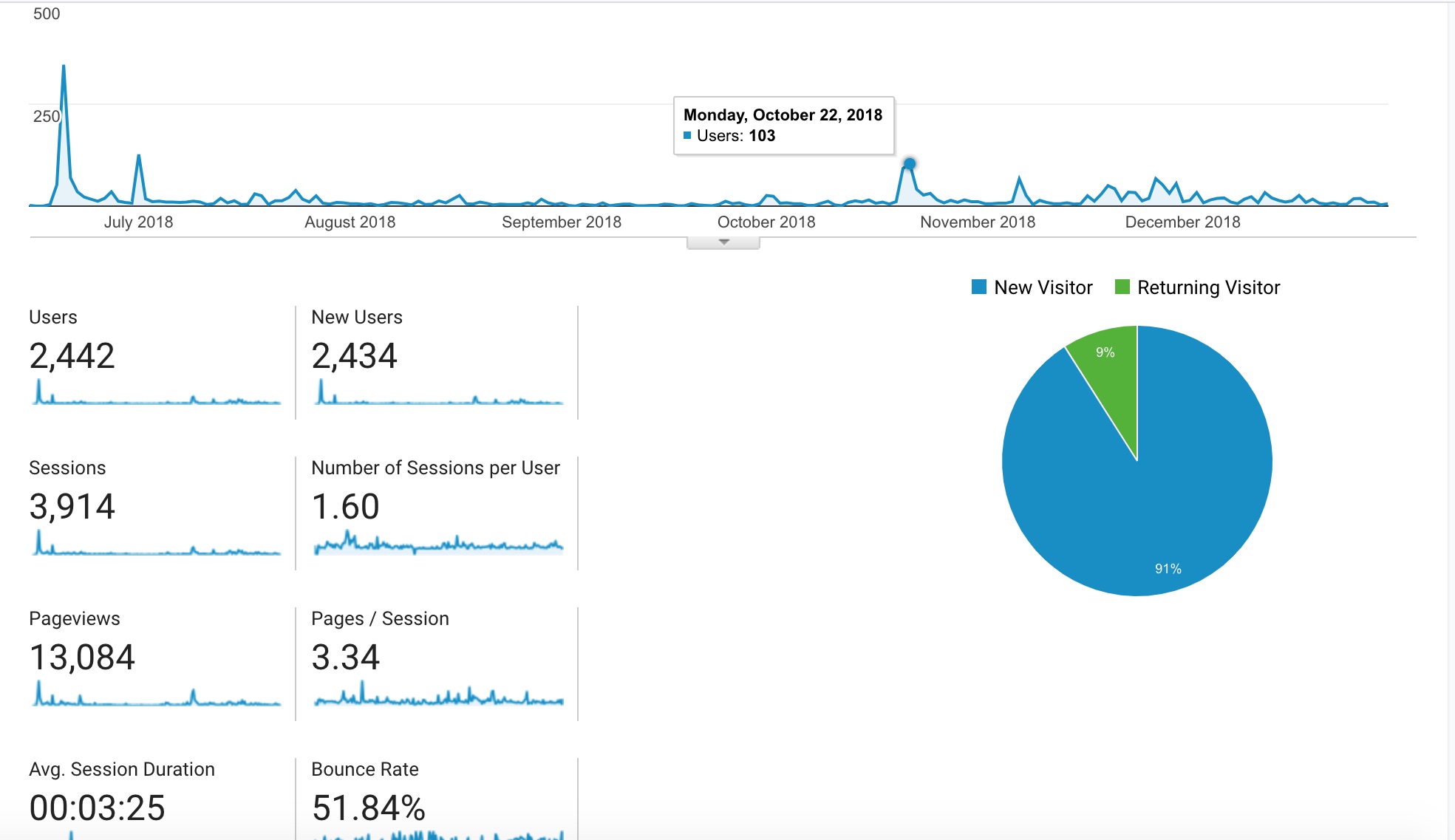

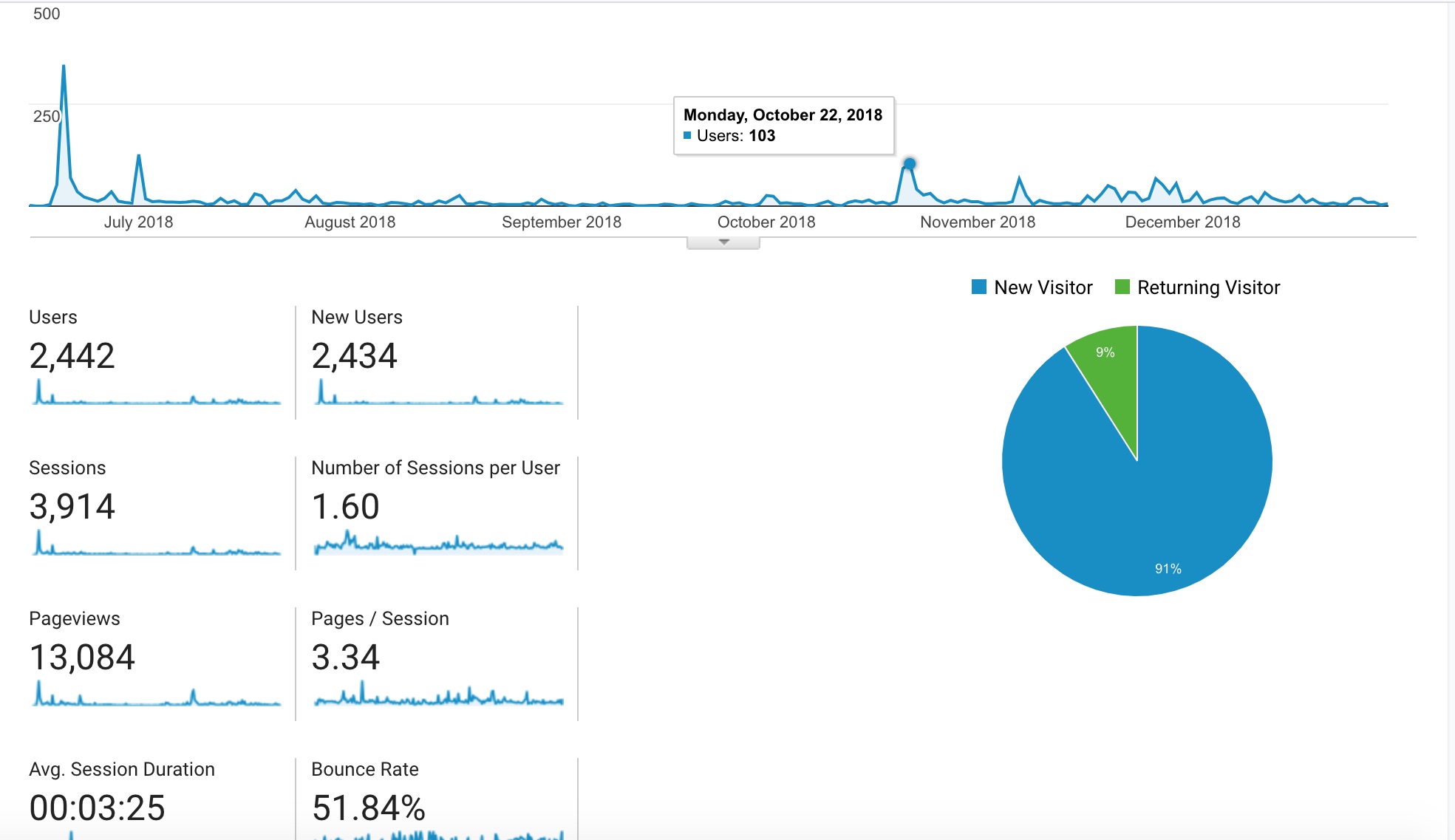

The usage over the past 6 months has been promising. (I didn't have analytics setup for the first half, rookie mistake) Since then there have been 2442 Users, 13084 page views and average session duration of 3 Minutes 25 Seconds. That implies Users spent time on shareseer for a collective of 500,610 seconds or about 139 hours of collective time. Thats promising enough for me to keep improving the service.

The biggest challenge I faced and still do is the distribution of the service. The first version was well received on r/securityanalysis and r/finance which was a plain vanilla 10-k/10-q search but the more enhanced 2nd version was shot down quickly as self-promotion. That in turn forced me to be a better redditor.The second wave of users came from twitter and r/CFA. I got a huge deal of feedback from anonymous redditors.I am amazed at the power of the internet.

In between a few twitter users were kind enough me to give me feedback. That combined with a couple of calls that friends set up with people in the industry allowed me to validate the idea. A dear friend contributed his time and skills to help build this, which allowed me to iterate faster. I've met people I otherwise wouldn't and learned a tremendous amount.

So whats next? I have a feature list that will probably take me longer than a year to implement. I am still on the hunt for pain points from investors. I want to enable both wealth managers and individual investors gain insights that they would otherwise miss out on. I started out with a mission to make investment research efficient, now I want to take it to the next level by creating a personal assistant for investors. If you are a wealth manager or investor reading this post I would love to connect with you to learn about your pain in researching companies. Shoot me a note at

contact@shareseer.com .

The biggest challenge I faced and still do is the distribution of the service. The first version was well received on r/securityanalysis and r/finance which was a plain vanilla 10-k/10-q search but the more enhanced 2nd version was shot down quickly as self-promotion. That in turn forced me to be a better redditor.The second wave of users came from twitter and r/CFA. I got a huge deal of feedback from anonymous redditors.I am amazed at the power of the internet.

In between a few twitter users were kind enough me to give me feedback. That combined with a couple of calls that friends set up with people in the industry allowed me to validate the idea. A dear friend contributed his time and skills to help build this, which allowed me to iterate faster. I've met people I otherwise wouldn't and learned a tremendous amount.

So whats next? I have a feature list that will probably take me longer than a year to implement. I am still on the hunt for pain points from investors. I want to enable both wealth managers and individual investors gain insights that they would otherwise miss out on. I started out with a mission to make investment research efficient, now I want to take it to the next level by creating a personal assistant for investors. If you are a wealth manager or investor reading this post I would love to connect with you to learn about your pain in researching companies. Shoot me a note at contact@shareseer.com .

The biggest challenge I faced and still do is the distribution of the service. The first version was well received on r/securityanalysis and r/finance which was a plain vanilla 10-k/10-q search but the more enhanced 2nd version was shot down quickly as self-promotion. That in turn forced me to be a better redditor.The second wave of users came from twitter and r/CFA. I got a huge deal of feedback from anonymous redditors.I am amazed at the power of the internet.

In between a few twitter users were kind enough me to give me feedback. That combined with a couple of calls that friends set up with people in the industry allowed me to validate the idea. A dear friend contributed his time and skills to help build this, which allowed me to iterate faster. I've met people I otherwise wouldn't and learned a tremendous amount.

So whats next? I have a feature list that will probably take me longer than a year to implement. I am still on the hunt for pain points from investors. I want to enable both wealth managers and individual investors gain insights that they would otherwise miss out on. I started out with a mission to make investment research efficient, now I want to take it to the next level by creating a personal assistant for investors. If you are a wealth manager or investor reading this post I would love to connect with you to learn about your pain in researching companies. Shoot me a note at contact@shareseer.com .